What are End of Life Arrangements?

Your end-of-life plans will help you establish your legacy and take enduring responsibility for difficult decision making — so your family will not need to. These decisions affect your health care expenses, your assets and liabilities, funeral arrangements, and your estate’s final stages. This checklist can guide you through the topics that influence the decision-making processes and outlines important documents you might need.

Benefits to Creating an End of Life Plan

Having a plan in place with your end of life wishes can help alleviate the burden of important decision making from family members and ensure that your wishes are honored.

End-of-Life Wishes Checklist

During estate planning, you express your wishes regarding what you want to see happen during the final stage of your life. Your final planning documents cover the details of your care choices as well as how extensive your care will be. Your checklist should include matters involving your finances, beneficiaries including spouse and minor children, medical care, and funeral arrangements.

End of Life Plan for Finances

When it comes to financial matters in regards to end of life planning, it is important to have a plan in place and get your financial affairs in order. Some important financial decisions to consider are:

- Settling any outstanding debts

- Retirement planning including a retirement account to help with living expenses and living arrangements such as hospice care or assisted living

- Life insurance policies and death benefit

- Naming any beneficiaries on your bank accounts, properties, and other physical and digital assets

- Keeping track of bank account numbers and other important financial information

- Designating a financial power of attorney for your financial matters

- Creating a will and/or trust

If you need professional guidance, a financial planner may be able to assist you and answer any financial questions you may have.

List Your Assets and Debts

One of the first steps to financial planning is going through all of your assets and debts. You will want to make a list of all of your assets including properties, vehicles, jewelry, electronic devices, furniture, tools, artwork, and any other valuables you may have. You will also want to include any digital assets you have such as bank accounts, 401(k) plans, and IRAs for example. Keep track of account numbers and other important financial information.

For any debts you have, you will want to make a list and pay-off or settle outstanding debts. You can also run a credit report to help you track your current debts and keep information up to date.

Create a Retirement Plan and Savings

Retirement planning and establishing a savings or life insurance policy can help with any planned or unexpected end of life expenses such as an assisted living home, medical expenses, and funeral expenses.

You will want to check on the details of your accounts to find out about the process for transfer to beneficiaries. Some types of accounts such as bank savings and CD’s may be set up or changed to have a transfer on death designation. This type of designation allows your assets to be transferred to your beneficiaries without going through a probate process.

Choose Beneficiaries, an Estate Administrator, and a Will

Another important step to financial end of life planning is to establish who your beneficiaries will be and choose a responsible individual to be in charge of administering your will after your death.

You will also want to create a will to designate to whom your assets will go and other important legal decisions such as guardians for minor children and the handling of money.

There are legal challenges for parents leaving money behind for their children. The best way to handle money is if you designated an adult to be the heir to the money until the child turns 18. If you can’t provide legal guardians, courts can enforce this provision. You can identify beneficiaries in your final will and testament.

End of Life Care Medical Plan

Another crucial part to end of life planning is establishing a medical plan with your health care preferences. Even if incapacitated, you can have control over your health. This can be done by providing your healthcare options in advance care instructions referred to as a living will or advance directive. These legal documents contain information regarding the preferences you choose to have at end-of-life, including medical treatment and medical intervention.

Advance Care Directives

Advance care directives are legal documents describing your wants for medical care in the case you are not able to speak or make your own decisions. An advance health care directive typically addresses your medical wishes in regards to life support, resuscitation, intubation, hospitalization, and donation of organs. Advance care directives may include a living will and/or a healthcare power of attorney.

Health care Power of Attorney

A medical power of attorney is a legal document that allows you to nominate a trusted individual to act for you in the event of mental impairment. It’s different from a financial power of attorney since the appointed person or their “appointed agent” has no control over your finances.

The appointed person named in the medical power of attorney is referred to as a proxy or health care proxy. In cases where your medical needs are impaired, medical power is granted on your behalf to your healthcare proxy to provide the doctor permission to do surgery or a lifesaving procedure or can also include decisions regarding the withdrawal of medical treatment.

Living will

A living will is a legal document containing information regarding medical treatments and what you wish to happen in the case of a medical emergency. Some decisions you may want to consider when creating this document are decisions about:

- Life support which encompasses a large number of machines such a ventilators, tube feeding, medications, or therapy used for keeping our bodies functional. The doctor can put you on life support temporarily after surgical operations. However, the use of life aid can become controversial if you have a terminal illness or long-term medical problem.

- Orders of resuscitation: Resuscitation is a procedure involving CPR that can help someone when they stop breathing. CPR may involve breathing tubes or mouth-to-mouth resuscitation. If you don’t want CPR or a life treatment, you should make it clear in your advance care directive with a do-not-resuscitate order (DNR). A DNR is a written order to notify hospital staff to not engage in CPR if a patient’s heart stops or breathing stops.

- Organ and tissue donation: In the US about 1.2 billion people wait for an organ for their lives and about a third die each day without their organ being available for use in their daily living situations. When organ donation is required in the case of a patient who dies, this is a crucial part of a health directive. Alternatively, tell your physician if you have a donor card. To be viable, body parts have to be extracted quickly and it is therefore essential to plan ahead if you wish to be an organ donor. Generally tissue transplants do not require waiting lists, so tissues may be used if they have been needed. Organ transplants must be carried out within hours from the time the donor dies. Transplantable organs can be retained for five years. You can decide to make either of these.

Memorial and Funeral Arrangements

Create Your Own Obituary

Many times obituaries are only written after someone’s death; however, you can choose to write your own obituary ahead of time or talk to trusted friends about what you would want included in it. Usually an obituary will give the details for a person who died including a complete name, birthdate, hobbies and interests, important life events and accomplishments, and the names of a surviving spouse and children or other family.

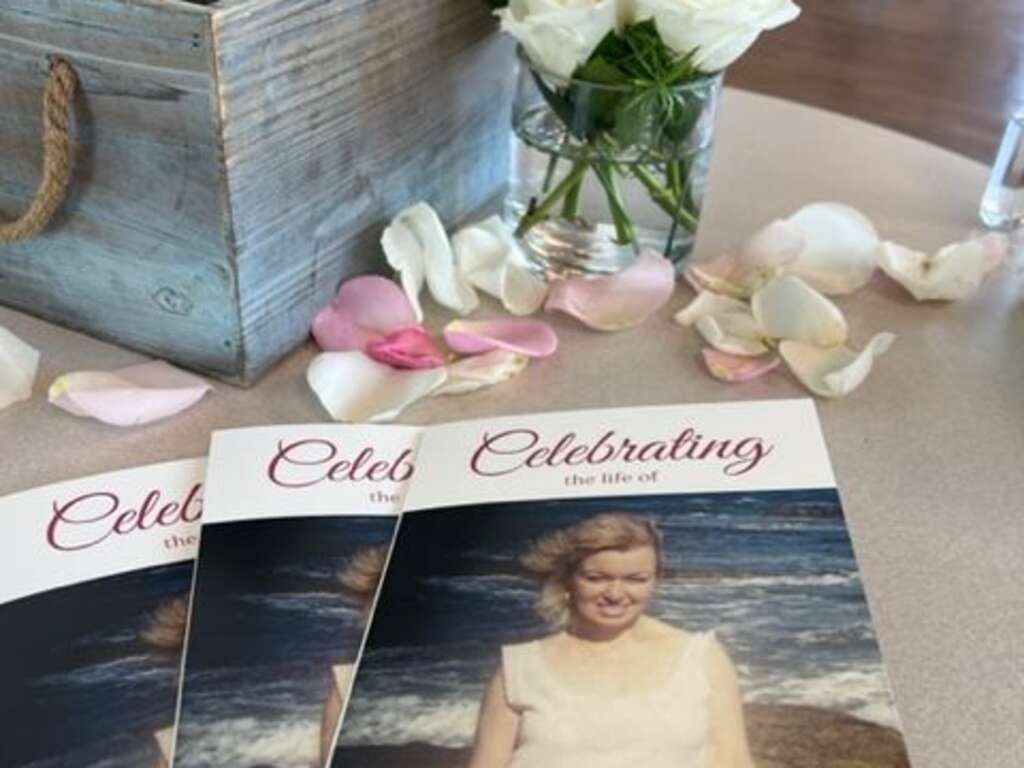

Decide on Funeral and Burial Arrangements

Planning your funeral is an amazing gift that you can give to family or friends. Grief can be overwhelming to us and having to take care of the funeral planning may be too much for some. If you prepare a plan well in advance, this can ease the burden. Think about your spiritual beliefs, final desires, and plans for the way in which you would like your memorial to take place.

You may also want to consider what type of funeral you would want to have such as a traditional funeral in a funeral home, a memorial service, or a celebration of life event and a final resting place and whether you would prefer cremation or burial service.

Review Your End of Life Planning Documents

An estate plan is a collection of actions, decisions and documents that ultimately guide your decisions in relation to your minor children or other beneficiaries, your estates and the financial assets you have. Your decisions in regards to your funeral plans are also apart of the overall estate plan.

Your final plan must include numerous legally binding documents and entities such as the advance care directive, medical proxy, and last will and testament.

Letter of Intent

Typically letters of intention express your end-of-life choices in your own words. It also lists your preferences regarding the funeral, a list of beneficiaries, instructions for the care and handling of pets, and usernames and passwords for Internet and social media accounts. Although the letter of intent is not legally binding it may assist families through their estate planning.

Financial Power of Attorney

A Financial Power of Attorney is a legal document that gives a designated person power to make financial and legal decisions for you. In addition, an adult child can have the right to control his or her own money and finances. The language in the power of attorney documents determines what power each holder can have. This may include complete authorization to purchase or sale properties in your name, or the execution of a transaction for you.

Living Trust

Living trusts represent the legal entity who controls your estate after your death, and distribute them as you wish. Assets in a living trust aren’t eligible for court probate. You must have legal help establishing a trust before moving property to this trust. So a little initial work would be needed. But you are saving your family members time and money. They’ll have no hassle going through court proceedings. Living trusts cost more to create & maintain than wills.

Last Will and Testament

Your testament is a different form of your living testament. Unlike a living testament, a final will outline a person’s wishes after death. Your testament specifies the distribution of your wealth after you die. It is accompanied by a statement stating: When someone dies, probate is commenced. This is an administrative process which authorizes the final will and testament, enabling proper distribution of estate.

How to Improve the End of Life Planning Conversations?

It is probably difficult to talk to your friends or loved ones about your final wishes, and it is important for you to talk about this process. Obviously, this is even more important if a medical diagnosis has happened recently. Planning what to say and determining the manner and way to proceed is incredibly helpful. There are several steps that can help people talk to friends and family about their death wishes. Get engaged and be fully present. Make eye contact. Be gentle. Be truthful. Keep conversations factual based.

End of Life Planning and Celebration of Life with Eternally Loved

At Eternally Loved, our goal is to help alleviate the stress of planning a memorial service or celebration of life event so that family and friends can be present, receive support, and honor their loved one.

Our event planner services include a complimentary consultation to determine your memorial service needs, coordination and contracting with all service providers, and staying involved throughout the entire process to ensure a successful and memorable event.

We will also consult with you to provide invitations, releases, execution of personalized theme, memorable elements, video presentation, and general coordination.

If you are planning a celebration of life service and need assistance, please contact us for more information.

Living Funeral

A living funeral or living memorial is an event that takes place before the funeral with the intention of preparing for the person’s death. It allows loved ones to express love, gratitude, and sentiments to the honoree that may have a terminal illness before they pass.

Eulogy

A eulogy is a speech, either written or spoken, that praises the life of someone who has died. It is usually given at a funeral or celebration of life and focuses on the life of the loved one who has passed and special memories or stories one has of them.

Non Religious Funeral Readings

Non-religious funeral readings are often chosen for a loved one who was not religious or spiritual and to provide comfort and closure to those grieving. These types of readings can reflect the person’s personality and interests — for example, if they were an avid reader or writer, then their favorite poem might be read during their funeral service.

Final Wishes Planning

One of the most important aspects of end of life planning is to draft a will. A will is the document that contains your final wishes for how you want your assets distributed after you pass away.